san antonio fl sales tax rate

The sales tax jurisdiction. This includes the rates on the state county city and special levels.

U S Cities With The Highest Property Taxes

The property tax rate for the City of San Antonio consists of two components.

. There is no applicable county tax. San antonio in texas has a tax rate of. The San Antonio Sales.

The Florida sales tax rate is currently. San Antonio TX 78283-3966. Maintenance Operations MO and Debt Service.

625 percent of sales price minus any trade-in allowance. Florida gives real estate taxation rights to thousands of locally-based governmental units. The December 2020 total local sales tax rate was also 8250.

San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling 2. Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. There are approximately 3897 people living in the San Antonio area.

The minimum combined 2022 sales tax rate for San Antonio Florida is. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value. This is the total of state county and city sales tax rates.

City of San Antonio Property Taxes are billed and collected by the Bexar County. 2020 rates included for use while preparing your income tax deduction. How San Antonio Real Estate Tax Works.

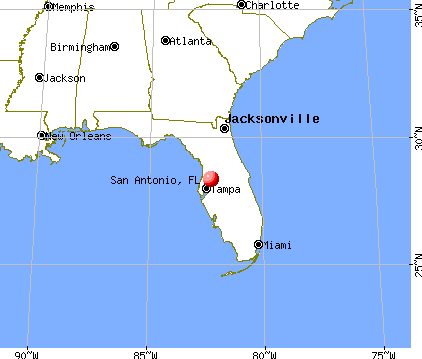

San Antonio is located within Pasco County. This is the total of state county and city sales tax rates. The latest sales tax rate for San Antonio FL.

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. What is the sales tax rate in San Antonio Texas. Remember that zip code boundaries.

Monday - Friday 745 am - 430 pm Central Time. Still taxpayers most often get a single combined tax bill from. The Fiscal Year FY 2023 MO tax rate is 33011 cents.

The San Antonio Florida sales tax rate of 7 applies in the zip code 33576. Floridas general state sales tax rate is 6 with the following exceptions. The average cumulative sales tax rate in San Antonio Florida is 7.

This rate includes any state county city and local sales taxes. This includes the rates on the state county city and special levels. The minimum combined 2022 sales tax rate for San Antonio Texas is.

The average cumulative sales tax rate in san antonio texas is 822. The current total local sales tax rate in San Antonio TX is 8250. The San Antonio Mta Texas sales tax is 675 consisting of 625 Texas state sales tax and 050 San Antonio Mta local sales taxesThe local sales tax consists of a 050 special.

Florida Sales Tax Rates By City October 2022

Moving From California To Florida Benefits Cost How To

How To File And Pay Sales Tax In Florida Taxvalet

Vista At Prescott Oaks By Meritage Homes New Homes For Sale In San Antonio Tx

New Homes For Sale Near West Chapel Mirada Lgi Homes

The Most Tax Friendly States To Retire

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

San Antonio Florida Fl 33576 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Taxpayers Property Appraisals Rising 20 To 50 As Supply Chain Disruptions Meet Population Growth The Texan

San Antonio Florida Fl 33576 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Florida Sales Tax Rates By City County 2022

Mirada By D R Horton Tampa North In San Antonio Fl Zillow

New Mexico Sales Tax Rates By City County 2022

State And Local Sales Tax Rates In 2017 Tax Foundation

Texans Don T Pay More Taxes Than Californians Do Reports Show Texas Thecentersquare Com

How To Get Tax Refund In Usa As Tourist For Shopping 2022

San Antonio Fl Real Estate San Antonio Fl Homes For Sale Zillow